|

The primary market is slowly becoming more

discerning about who it lets in, with investors

not hesitating to turn their backs on companies

they think don’t make the cut.

Since 2011-12, of the 132 IPO applications

approved by the Securities and Exchange Board of

India (SEBI), 67 lapsed. In the three months from

April to June this year, of the 13 companies that

SEBI cleared to launch their IPOs, seven didn’t

come to the market.

This is much higher than in the whole of FY15,

when four out of 16 IPOs failed to make it.

A merchant banker, who did not wish to be quoted,

said there is more “investor pushback now because

they disagree about a company’s valuations or

business fundamentals”.

In some cases, the company fails to enthuse

institutional investors during the roadshows and

publicity programmes to attract investors. If

institutions don’t show adequate interest, the IPO

is mothballed before retail investors even hear

about it.

In other cases, the timing has gone wrong or the

market environment may have changed since

receiving SEBI’s clearance. For instance, the

Catholic Syrian Bank public offer was delayed as

the market’s appetite for banks declined and asset

quality concerns surfaced. (The bank’s IPO

clearance will lapse on June 22.)

More companies may be turned away now as investors

are biased towards large IPOs. “When a company is

seen to be raising a lot more money,” another

banker said, “it gives the impression of being

more liquid, less volatile. So now, if there is a

₹300-crore IPO by a company in the infrastructure

space, there aren’t going to be many takers for

it.”

Public offer process

When a company wants to make a public offer for

its shares, it hires a merchant banker to draft an

offer document — which lays out details about the

company, its business and the share offer. This

document, called a draft red herring prospectus,

is submitted to SEBI. The capital market regulator

gives the IPO the green signal after it examines

the document and is convinced that the offer is

genuine. This clearance is valid for 12 months,

within which time the company must complete the

entire offer process.

Most companies try to complete the process within

three to six months of getting the go-ahead.

For example, SEBI clearances for four companies

issued in April-June 2015 — AGS Transact

Technologies, SMC Global Securities, Shree Shubham

Logistics Ltd and Amar Ujala Publications — have

expired. Together, they would have raised about

₹1,800 crore in fresh equity. Catholic Syrian

Bank’s public offer period ends in a fortnight; it

had planned to raise ₹400 crore. Two other

companies — SSIPL Retail Ltd and Dilip Buildcon —

have since filed revised documents with SEBI after

their first clearances lapsed.

(The companies named here and their merchant

bankers either did not respond to emailed

questions or declined to go on record about their

IPO plans.)

On the bright side, in FY16, 22 companies raised a

total of ₹16,565 crore through IPOs, the highest

in the past five years, according to data with

Prime Database.

The ones left behind are naturally filtered out by

investors, the first banker said. “They might

choose to come back when the timing is better.”

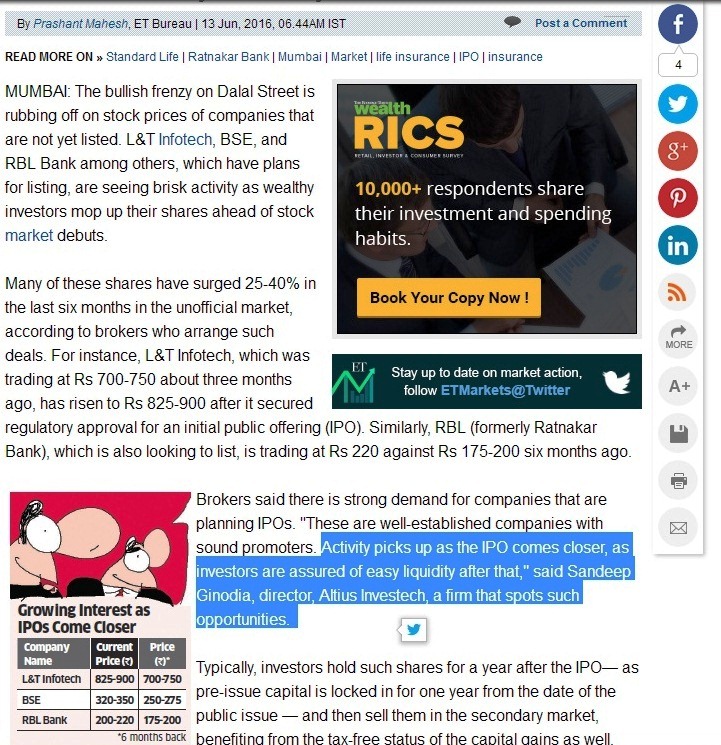

MUMBAI: The Tata Group has revived plans to list Tata Technologies, an engineering solutions and IT product developing arm of Tata Motors, on the local bourses. The company is planning to raise Rs 1,400 crore through an initial public offering (IPO), said two people with direct knowledge of the plan. The proposed share sale will be the first IPO from the Tata Group in 12 years after TCS in July 2004.

An email query sent to the company and Tata Motors did not elicit any response till the time of going to press.

Tata Motors holds 70.43 per cent stake in Tata Technologies, while Alpha TC, a wholly-owned subsidiary of the partnership sponsored by Mizuho Securities and other international investors, owns 8.71 per cent in the company.

Other investors in the company include Tata Capital, Barclays Wealth Corporate Services, Sheba Properties, Tata Entertainment Overseas and Walbrook Nominees, which own between 1 per cent and 5 per cent each.

Tata Technologies was planning an IPO in 2008 to fund expansion and repay some of its debts, but the plan was dropped due to the global market meltdown.

For the financial year ended March 31, the company reported revenue of Rs 2,686.20 crore, up 3.6 per cent over the previous year. The company's net profit for the year was Rs 382 crore, up 14.25 per cent from last year. TATA Technologies which started as a design company in 1994 for Tata Motors' automotive business, now earns one-third of its revenue from North America, Europe and the Asia-Pacific re gion. Nearly 65 per cent of its business comes from the automotive sector, 12 per cent from aerospace and the rest from industrial machinery and other businesses.

Sandip Ginodia , Director

We deal in over 60 unlisted companies with 15 years of experience .

Email : ginodiasandip1@gmail.com

Source : Economic Times

Tamilnad Mercantile Bank Ltd (TMB)

Net Profit growth of 6% to Rs.402.16 Cr from Rs.379.40 Cr (Last year).

Book value also has risen from Rs.91,203/ per sh (last year) to Rs.1,03,000/ per share as on 31.3.16.

2nd interim dividend of Rs 40 paise per share(after bonus).

For Tamilnad Mercantile Bank (TMB), growth will be driven by micro/small enterprises, retail and trader segments and mid-corporates in a limited way, said HS Upendra Kamath, Managing Director and Chief Executive of the bank.

In 2015-16, the bank recorded a net profit growth of 6 per cent to ₹402.16 crore from ₹379.40 crore in the previous fiscal (FY15).

Total business rose 17.70 per cent to ₹52,946.59 crore (₹44,985.91 crore in FY15). The bank has set a business target of ₹60,000 crore for the current fiscal.

The new board, which assumed charge in March this year, has declared 500 bonus shares for every shareholder. “This would involve a transfer of about ₹120-130 crore from reserves to equity. Such bonus shares have already been issued to around 4,000 of the 18,000-odd shareholders,” Kamath said.

The book value of the share has risen from ₹91,203/share last year to ₹1.03 lakh this year. The net worth has risen to ₹2,948.54 crore from ₹2,594.31 crore a year ago. Deposits grew 18.40 per cent to ₹30,368.88 crore (₹25,649.86 crore) and advances by 16.77 per cent to ₹22,577.71 crore (₹19,335.95 crore). Net non-performing assets (NPAs) rose to ₹199.90 crore from ₹128.96 crore, up from 0.67 per cent to 0.89 per cent of total advances.

IPO plans

On the bank’s plans to float an initial public offering (IPO), Kamath said: “It is true that it has not become a reality. But this will not affect the bank, as it is adequately capitalised for the present and can take care of growth for the next two-three years.

“IPO, of course, is one way of raising capital, but there are other ways to raise resources as well. As of now, IPO does not seem to be on the anvil.”

Sandip Ginodia , Director

We deal in over 60 unlisted companies with 15 years of experience .

|

|